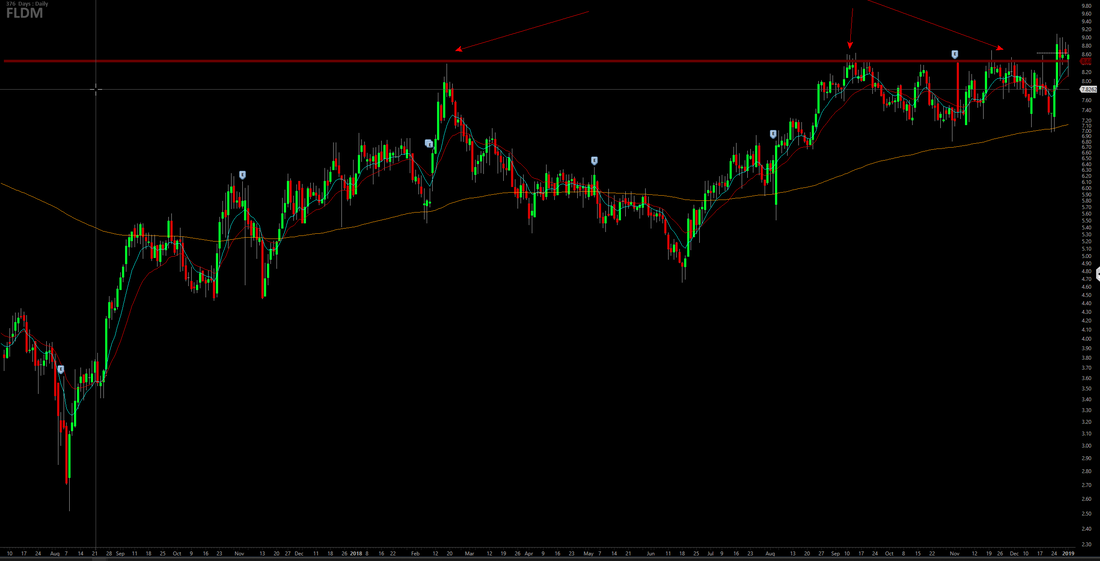

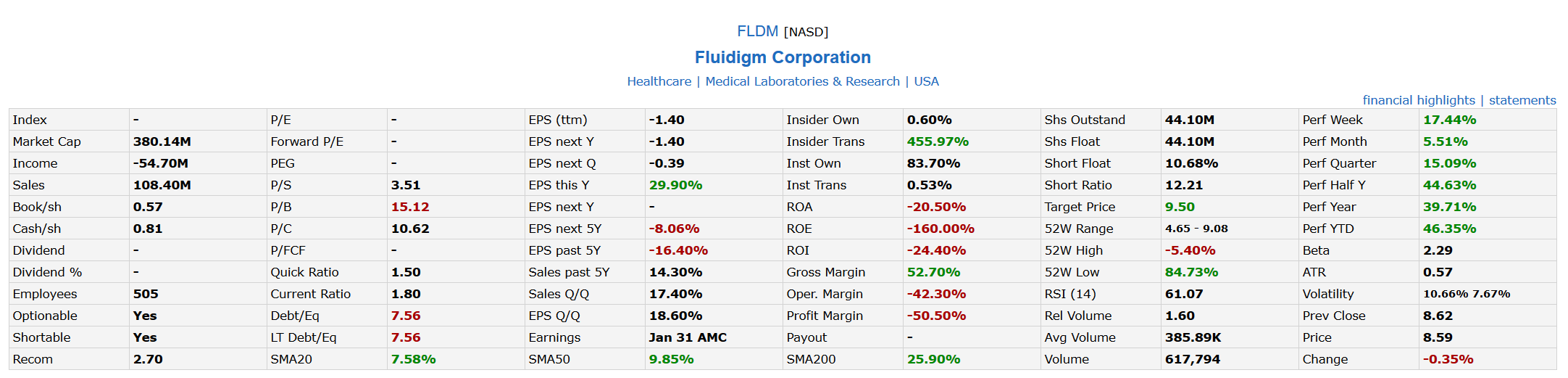

Buy Signal is around the corner on FLDM on of the cheap stocks below $10 Obsessively $8.44 is one of the best zones since February 2018. Bull flag formation on last 5 candlesticks, above Moving averages. |

Archives

January 2019

Categories |

|

Risk Disclosure

DISCLAIMER: Futures, stocks, Forex, and options trading involves substantial risk of loss and is not suitable for every investor. The valuation of futures, stocks, Forex, and options may fluctuate, and, as a result, clients may lose more than their original investment. The impact of seasonal and geopolitical events is already factored into market prices. The highly leveraged nature of futures trading means that small market movements will have a great impact on your trading account and this can work against you, leading to large losses or can work for you, leading to large gains. You are responsible for all the risks and financial resources you use and for the chosen trading system. You should not engage in trading unless you fully understand the nature of the transactions you are entering into and the extent of your exposure to loss. If you do not fully understand these risks you must seek independent advice from your financial advisor. Copyright © 2014-2024

|