|

People usually ask me about what kind of chart can trade based on price action? This is the really important when traders have some confusion about their methodology, mindset, and trading plan. Price action is really clear, you can trade what ever you wants. The point is to find the best charts to trade. In fact, choosing the best chart to trade is the first thing, price action traders do.

First, look for the clear Trend, when you find the clean trend like the chart you can see above, then wait for the best price. Patience is the second key of success. wait for the moment, let the market breath. Secondly, when you found the great chart, with clear price action, just take action. For instance, in the chart above you can see the clear trend in Walt Disney daily time frame, which has a up trend. If you are any doubt about trend here, you should stop working, and taking the PA course again from A-Z. there is no hard process, hard thing for traders is how to distinguish, deal, and manage the trade. you can see the entry price on 109, with the safe zone, and with open target price.

0 Comments

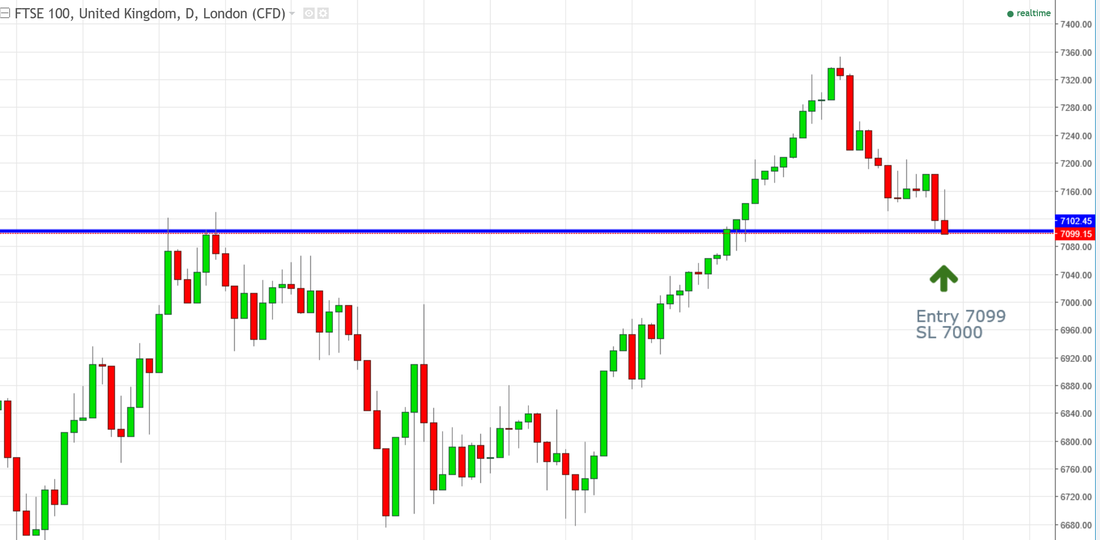

Open your February trades with very clear break out signal in FTSE 100 from level 7100 which broke since 2006. clear pull back is happening right now. Entry point is 7099, and because I usually give more room to indices trades, so my stop loss to protect my trade is around 7000. Even 7050 level also is a good level to place your stop loss there indeed. Time frame as you can see in the chart above is daily, so you should wait at least a week to see the result. Very classic, and clean chart with a great risk to reward ratio.

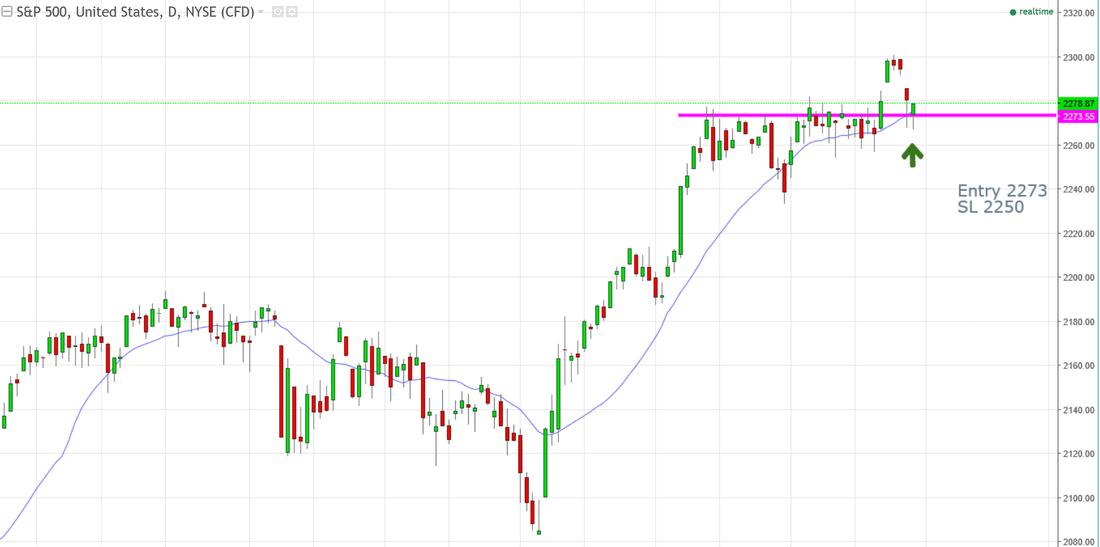

As the chart above shows, S&P 500 broke above the 2270 level, and now pull back to the 2273 level, and as a result in the bullish market, we have a great long opportunity. This is the daily time frame so if you are trading on daily time frame, you should expect to see take profit hit in next days. So, the key to be profitable in this time frame is he patience. These kind of trades are more like investing rather than trading indeed. proper entry point or in the better explanation level is 2273. In indices I give more room to price to move, so stop loss is set for 2250, and open take profit.

|

Archives

January 2019

Categories |

|

Risk Disclosure

DISCLAIMER: Futures, stocks, Forex, and options trading involves substantial risk of loss and is not suitable for every investor. The valuation of futures, stocks, Forex, and options may fluctuate, and, as a result, clients may lose more than their original investment. The impact of seasonal and geopolitical events is already factored into market prices. The highly leveraged nature of futures trading means that small market movements will have a great impact on your trading account and this can work against you, leading to large losses or can work for you, leading to large gains. You are responsible for all the risks and financial resources you use and for the chosen trading system. You should not engage in trading unless you fully understand the nature of the transactions you are entering into and the extent of your exposure to loss. If you do not fully understand these risks you must seek independent advice from your financial advisor. Copyright © 2014-2024

|