|

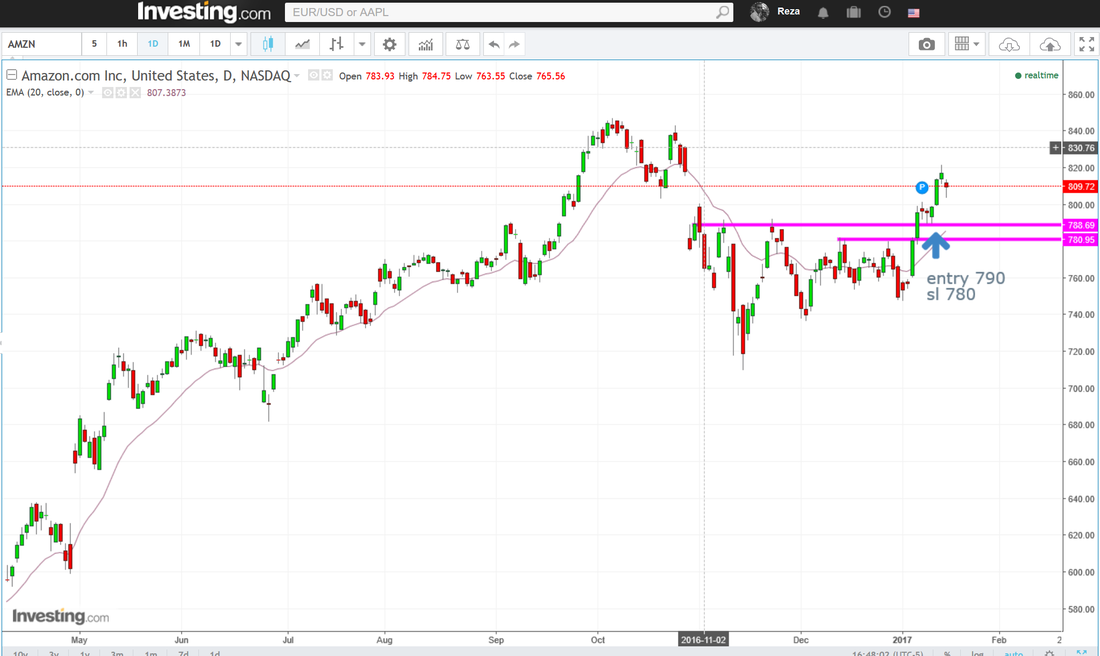

Another great example of break-out, pull back setup this time on Amazon.

As you can see in the daily time frame, amazon after spending three months on the consolidation area, after broke above the channel $788, and pull back to the level, respect the price action, now start to rise again. The Original entry point was $790, stop loss level sat at $780. And nearest possible turning point is level $840. So risk to reward equal to the $10 to $50 means 1 to 5. Very clear, and clean pure price action for this chart. Hopefully, you took this trade, and enjoy easy profit.

0 Comments

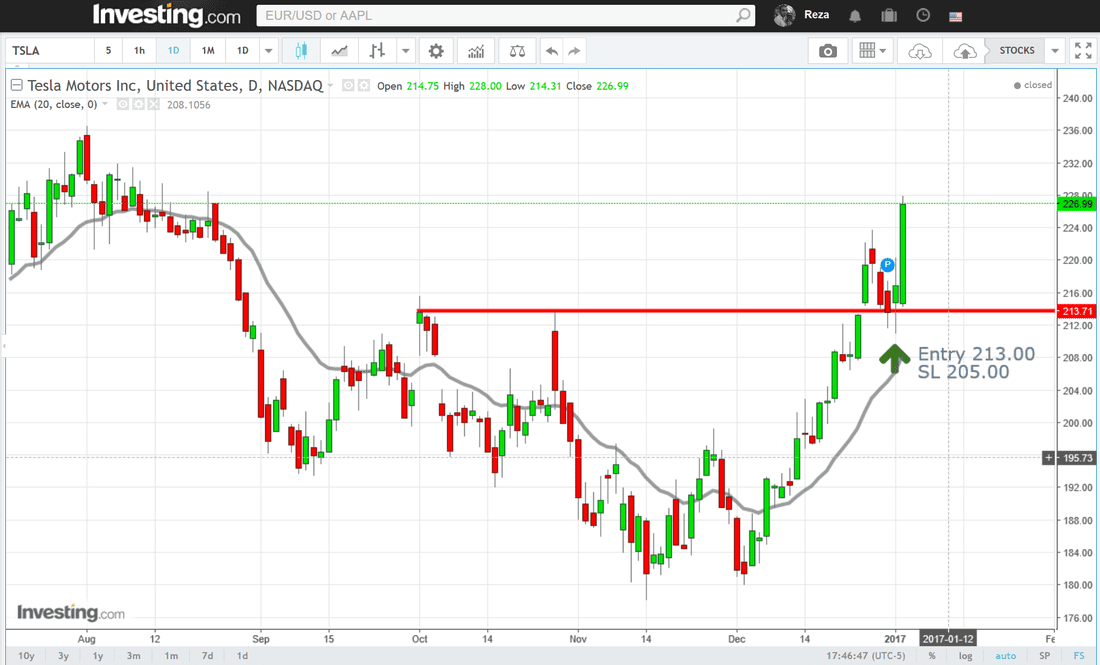

Let's take a look at TESLA chart. Price is in teh bullish trend since December. now, It is a good time for price after testing 213.00 to break the level and continue to rise. As you can see in the chart above, in Daily time frame we have a great opportunity to go long from 213.00 level, my suggestion is to set your stop loss below 205.00. in fact based on the US market and gaining in dollar, it make sense to go long at this time.

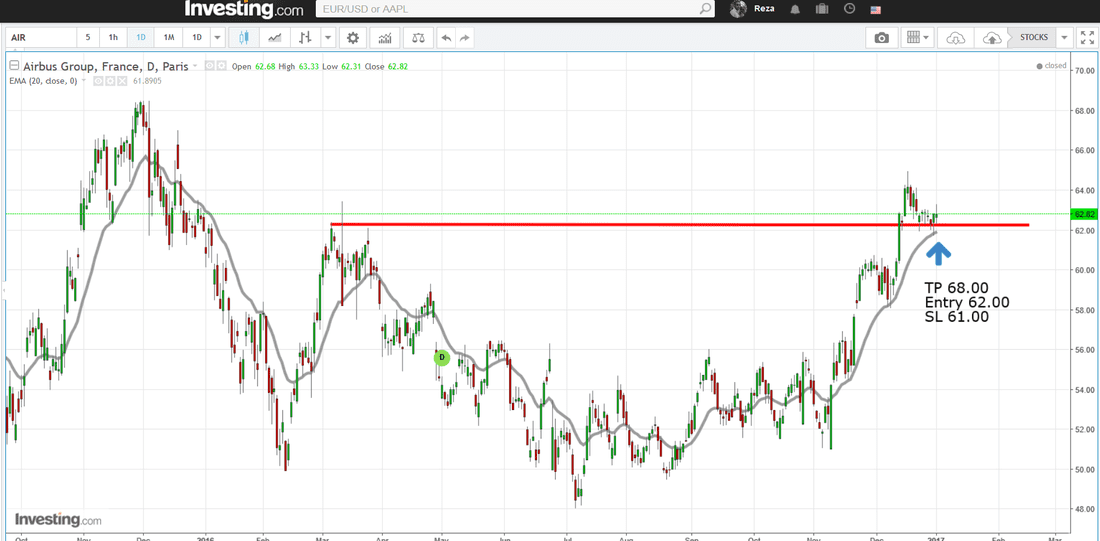

Let`s start trading in 2017 with really perfect long position on AIrBUS Group. As you can see in the chart above in daily timeframe, Airbus has a bullish condition. As I disscuss about break-out, pull-back strategy, it is clear that price broke through the 62.00 level which is the last highest point. so very clear long position, with 1 to 8 risk to reward ratio. cheers

As you may read my 15 December post about FTSE100 post, there was a great opportunity to go long on FTSE. now after 15 days, not much working days, you can see in the chart above, price hit our take profit area. Very clean trade with 1 to 5 stop loss to take profit ratio. which means if you risk just only 2% of your total account, now you should have at least 10% profit. cheers

|

Archives

January 2019

Categories |

|

Risk Disclosure

DISCLAIMER: Futures, stocks, Forex, and options trading involves substantial risk of loss and is not suitable for every investor. The valuation of futures, stocks, Forex, and options may fluctuate, and, as a result, clients may lose more than their original investment. The impact of seasonal and geopolitical events is already factored into market prices. The highly leveraged nature of futures trading means that small market movements will have a great impact on your trading account and this can work against you, leading to large losses or can work for you, leading to large gains. You are responsible for all the risks and financial resources you use and for the chosen trading system. You should not engage in trading unless you fully understand the nature of the transactions you are entering into and the extent of your exposure to loss. If you do not fully understand these risks you must seek independent advice from your financial advisor. Copyright © 2014-2024

|