|

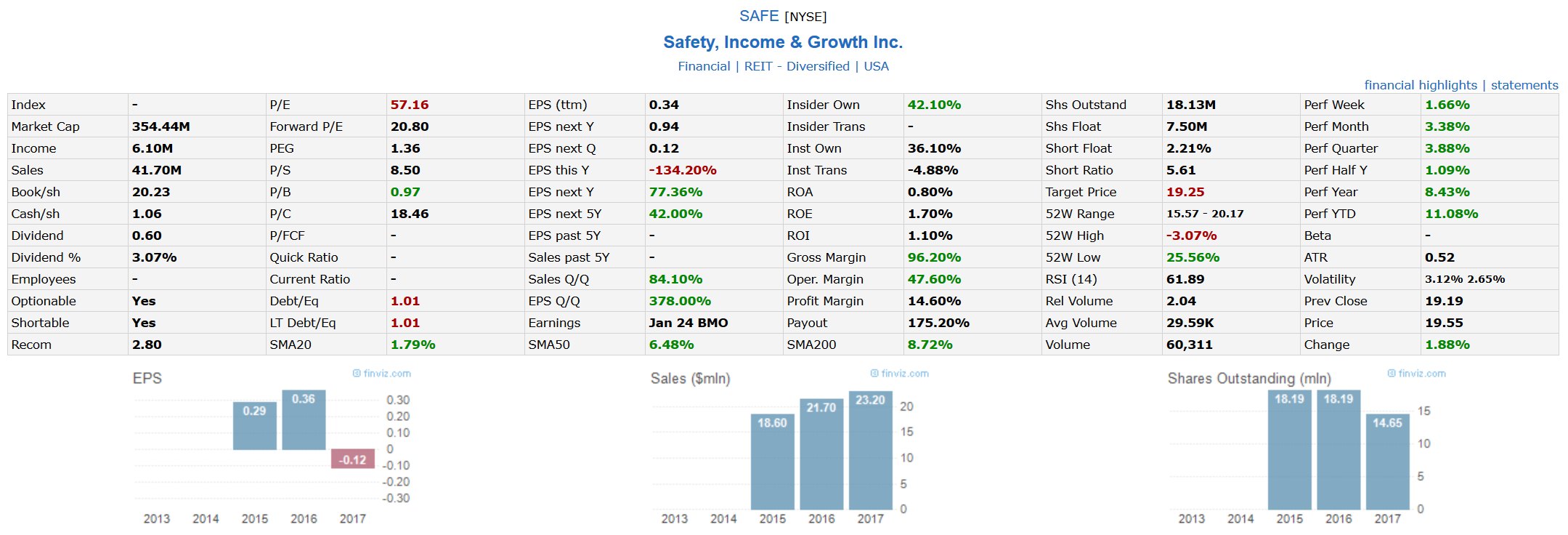

Trading is all about finding a proper chart reading techniques, plus super clear fundamentals foundation. Safety, Income & Growth Inc. (SAFE) is the first publicly traded company that focuses on acquiring, owning, managing and capitalizing ground leases. The Company seeks to provide safe, growing income and capital appreciation to shareholders by building a diversified portfolio of high quality ground leases. The Company, which is taxed as a real estate investment trust (REIT), is managed by its largest shareholder, iStar Inc. Additional information on SAFE is available on its website at www.safetyincomegrowth.com Start first with technical analysis based on weekly and daily charts price has to pass zone 19.87. Infact finding a perfect price is not a goal. The goal is to find a proper zone to take trades based on trading plan. Because of your broker or trading platform you will see the difference among support line in both charts. And also you can see time frames are not matter to this difference. That `s why I believe that these are a zones. Group of buyers and sellers in complex zone, yeah! Battle. It is Zone. So let`s take look at Fundamentals SAFE in 2017 was less share outsanding than before but now SAFE has 18.13M. Safety, Income & Growth Inc. (SAFE) announced today that the Company’s Board of Directors has declared common stock dividends of $0.15 per share for the fourth quarter of 2018. The dividend represents an annualized rate of $0.60 per share and is payable on January 15, 2019 to holders of record on December 31, 2018.

Charts looks good. Let`s do the math: Best entry is to break Zone, or wait for a nice first pull back. Around $20 would be Ideal but be cautions about false break out. Watch price action around there. Buy 1000 shares on $20 target is no man land. Stop loss is $18.50. Risk is $150 Reward is at least 1:5 $600 Commission around +$4.50

0 Comments

|

Archives

January 2019

Categories |

|

Risk Disclosure

DISCLAIMER: Futures, stocks, Forex, and options trading involves substantial risk of loss and is not suitable for every investor. The valuation of futures, stocks, Forex, and options may fluctuate, and, as a result, clients may lose more than their original investment. The impact of seasonal and geopolitical events is already factored into market prices. The highly leveraged nature of futures trading means that small market movements will have a great impact on your trading account and this can work against you, leading to large losses or can work for you, leading to large gains. You are responsible for all the risks and financial resources you use and for the chosen trading system. You should not engage in trading unless you fully understand the nature of the transactions you are entering into and the extent of your exposure to loss. If you do not fully understand these risks you must seek independent advice from your financial advisor. Copyright © 2014-2024

|